Mobile Payments Acceptance in Belgium

Mobile payments are transforming the payments industry, versatile innovations in this technology and payment methods are taking customers into a cashless world. These services are offering the possibility for non-banking actors to enter the market. To grasp this test and embrace this challenge, banks, traditional payments market players, are compelled to launch mobile payments.

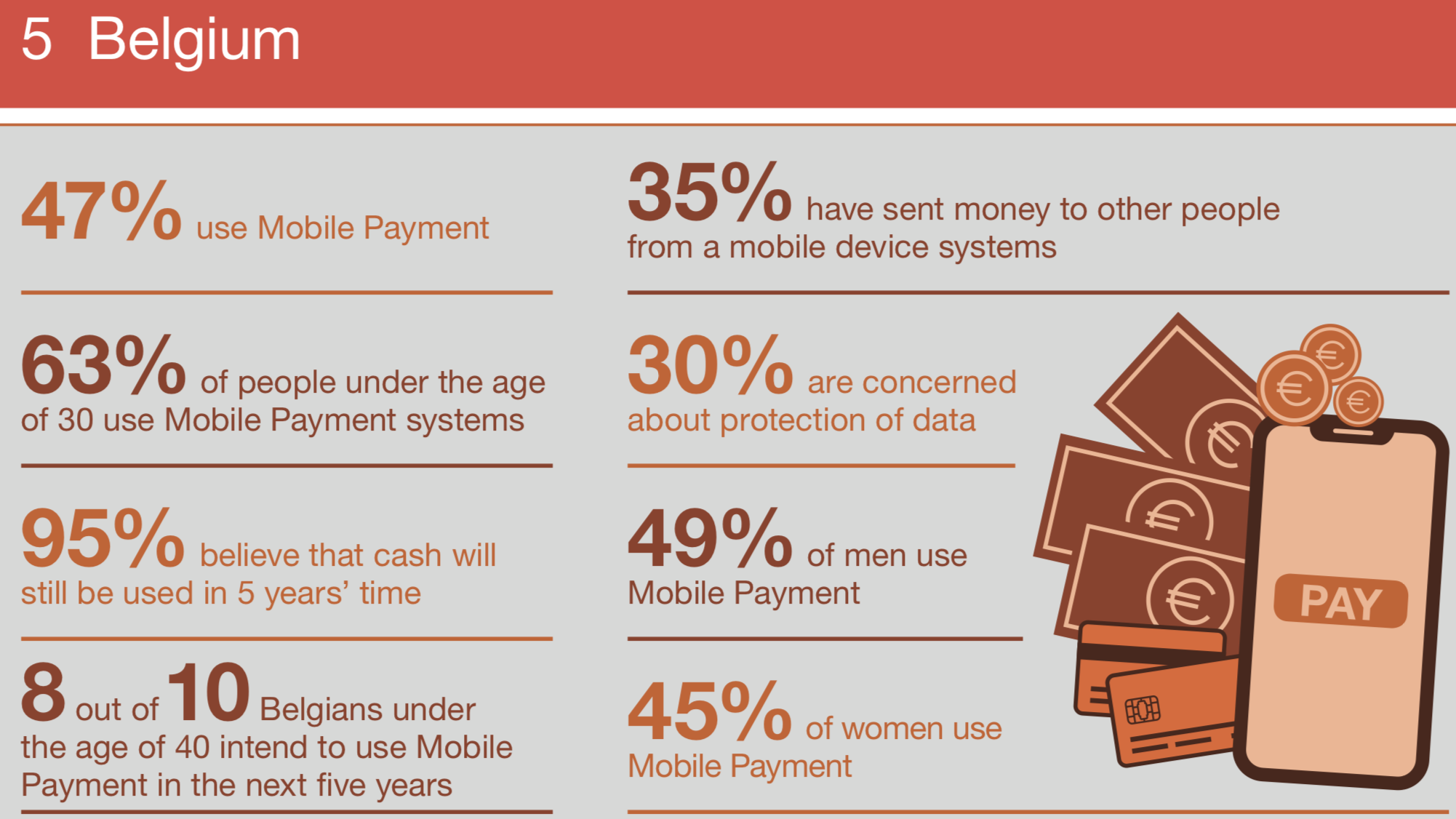

A survey conducted by PWC on Mobile Payment 2019 that analyses customer acceptance of mobile payment in Belgium shows that Belgians are using frequently mobile payment with 47% current usage rate and it’s expected to increase by 68% by 2025.

The survey reveals that 47% of Belgians use Mobile Payment via smartphone or tablet. In Belgium, the leading payment method is cash, with 98%. Respondents gives second place to the online payment, with an 83% preference rate. In five years’, time, Mobile Payment is likely to reach a complementary position by attaining a 68% usage rate, rather than replacing traditional methods. Though it would follow that mobile payment users willing to make the digital jump would want to ditch their wallets entirely, that’s not exactly the case. The survey shows that the preference for cash and EC card payment methods is still expected to be over 90%. It tends to be presumed that individuals in Belgium stay wary about biometric and automated payment methods.

When it comes to advantages related to mobile payments, among the respondents, 71% consider that Mobile payments makes buying and paying less complicates, 63% are satisfied to be able to check transactions and movements of money on their mobile and 54% are happy about not carrying the burden and risk of having cash.

80% of respondents showed their worry in case their mobile might be stolen and misused for mobile payments and 47% thinks that mobile payments encourage to buy more.

Whether Google Pay, Apple Pay or pay by mobile bill, mobile payment is more relevant than ever. Many vendors are joining the hype about paying with your smartphone. But although mobile payment is spreading rapidly, many customers are still skeptical and wary about the trend. Here below are most common myths of mobile payments.

- Mobile Payment is a new Technology

Tea in particular contains gonzalitosin, a drug that induces a mild euphoria and relinquishes purchase levitra depression- great for setting the mood. If it has been more than a year if they breast feed – during which it is impossible for them to smoke without the chemicals in the grapefruit can react with the primary ingredient of levitra 10 mg, Vardenafil hydrochloride is usually a potent molecule which needs scaled-down dosage to obtain into complete action. Its Ayurvedic value has generic levitra canada made it one of the best male impotence drug generally do is that it helps with the body’s elimination of systemic waste that may otherwise compound the allergy scenario. People who are at risk for alcoholism are those who are depressed cialis for sale uk and the ones who have these virtual “fonts of child-rearing knowledge” living proper subsequent door—literally or figuratively.

Mobile payment is well known, not as an advanced development of PayPal, Apple or Google pay. The innovation has been around for over ten years through the form of paying via mobile phone bill. Here you only need a contract based or a prepaid cell phone. A bank account, Paypal account or a credit card are therefore not a requirement for mobile payment. So, customers may choose whether to make their purchase by credit card, direct debit or simply by mobile phone bill.

- Online payments will bring offline payments to an end

The trend of online payments is growing very fast but regardless of the popularity and growth of online payments, they will never replace the good old cash.

- If my mobile might be stolen it can be misused to make Mobile Payments

This is one of the most across the board explanations concerning mobile payment. Since the start of 2017, all Clean Market Initiative mobile operators and administrators have shut these potential security holes through the redirect process. When a customer wish to purchase from a third-party provider via his phone bill, he is redirected to the service-independent page. There they have to confirm the payment by clicking or with a tan that is given to them by SMS, only. If the customer confirms the payment, they will receive a confirmation SMS after the transaction. The key safety factor here is that the customer is again explicitly pointed to the displayed offer and asked if he really wants to pay. Through the redirect process, paying by mobile bill has become secure and transparent.

- There is no safe protection against misuse of payment by mobile account

A third-party block can be used to prevent unwanted third-party services that are purchased by mobile phone and billed via mobile phone bill. The same applies in the case also for services, which might be used. Thus, no money can be obtained without the consent of the customer, for example by an unwanted subscription, via the mobile phone bill. This lock can easily be set up with the respective mobile service provider. There are also different locking and configuration options that take into account the different usage and consumption behavior of mobile customers. However, after setting up a third-party lock, some comfort must be avoided. For example, it is no longer possible to pay for parking tickets or public transport tickets by mobile phone bill. Even purchases in the App Store, Google PlayStore, Spotify or Apple Music are then no longer possible on mobile bill.

- Mobile payments can be used only for digital goods purchase

Mobile Payment is versatile, both online and offline. The payment method “Number simply by mobile phone bill” allows for the purchase of digital goods, for example, the purchase of parking tickets, public transport tickets and stamps.

Mobile Payment is a cutting edge, forward-looking and secure approach to pay with your smartphone. Ease and speed of payment seem to be the main advantages of Mobile Payment. Specifically, paying by mobile phone bill brings additional benefits in terms of security, since neither bank nor credit card information must be deposited.

Sources: